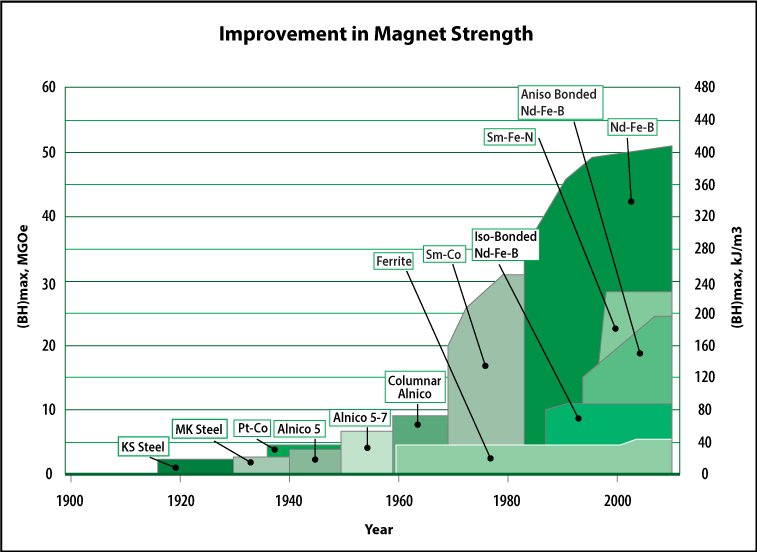

Attend any magnetics conference or seminar and I can guarantee a slide will appear in someone’s presentation showing something along the lines of the year of introduction of a permanent magnet material versus the corresponding (BH)max. I know when I am presenting I always use a variant of the figure shown below:

The one thing I always point out is that it’s now been 35 years since the last significant new material was announced by Sumitomo Special Metals and General Motors; namely materials based on the Nd2Fe14B tetragonal compound. This despite untold hours and $’s spent on a search for the next big thing in permanent magnets.

So why the fascination/obsession with (BH)max? Well it is an useful and practical index of permanent magnet performance since to a first approximation the higher the (BH)max value the smaller the volume of magnet required to generate a given flux density in a air gap. Of course it’s a bit more complicated than that but this is intended to be a short blog not a textbook plus I haven’t figured out how type out equations in LinkedIn!

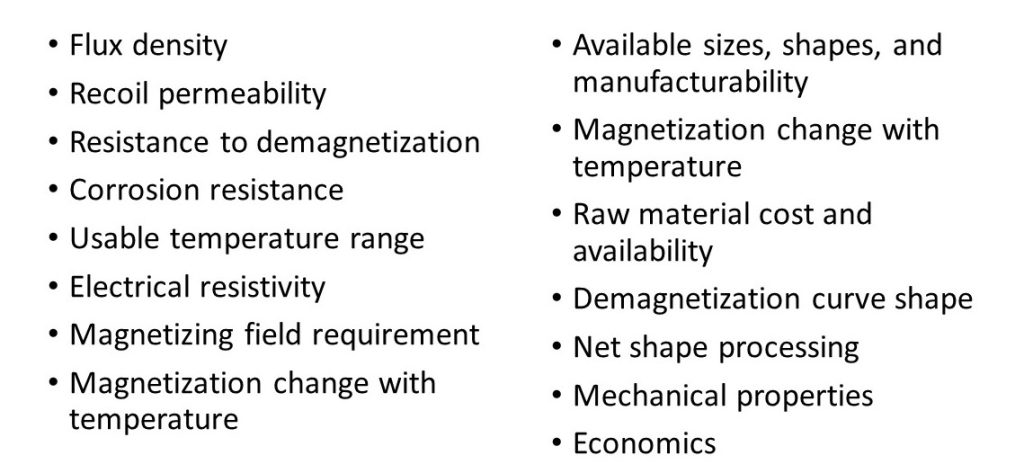

There are a lot of other criteria to consider when either selecting the right magnet for an application or understanding the degree of commercial success of a particular material in the market. Some of the considerations are shown below:

However, it occurs to me that there is some price-performance sweet spot that determines the degree of market success that is not expressed in the above list of criteria. This magic index is the subject of this article.

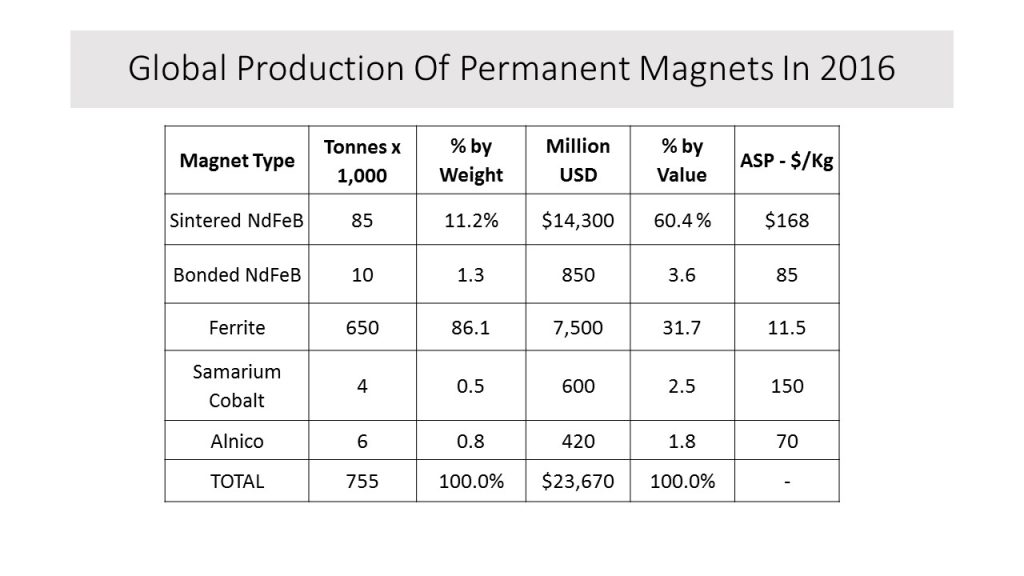

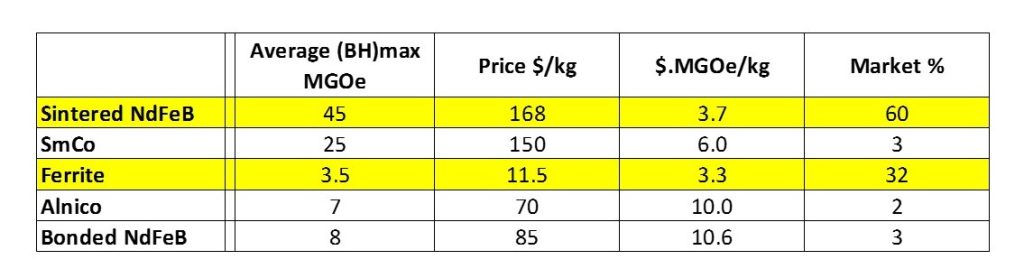

Today, there are 4 major classes of basic magnet material in commercial production; alnico, NdFeB, SmCo and ferrite. In addition there is a subset of products known as bonded magnets that combine these basic magnetic material powders in a non-magnetic binder. Most commonly used magnetic powders are ferrite and isotropic NdFeB. It’s become standard to think of all these material options as providing a continuum of (BH)max performance from 1 MGOe (isotropic ferrite) to 55 MGOe or higher (sintered NdFeB) except for a small gap between 12 MGOe (bonded NdFeB) and 18 MGOe (SmCo5). However, typically the relative market shares of these materials are not included in these discussion and hence no weighting is given to the relative commercial significance of the material options. The table below gives my estimate/guess of the global markets for these materials:

As can be seen two materials (sintered NdFeB and ferrite) account for over 90% of the market. The rest are all less than 5%; by my arbitrary definition they are niche materials. The two mass market (again by my arbitrary definition) magnets are ferrite and sintered NdFeB and yet they have dramatically different properties and performance characteristics. So if you are developing a magnet for the mass market I argue the performance gap is actually between 5.5 MGOe and 35 MGOe; a much larger gap than is typically discussed.

So I started wondering is there a metric that might indicate whether a material is destined to be a niche player or mass market behemoth. In the table below I simply divided the average price per kg by the typical (BH)max of the material to give a number with the ugly units of $.MGOe/kg. Interestingly the two mass market materials have similar values; the niche materials have values that are higher by at least 60%. My theory is that if the price-performance ratio is optimum then the market will figure out a way to fix or design around the disadvantages of the material e.g. low temperature demagnetization of ferrite, poor corrosion resistance of NdFeB. If the price-performance ratio is not optimum than the material remains a niche product since the market is less inclined to find a solution to the limitations.

So I will be the first to admit that this could be some arithmetical coincidence and as we all know correlation does not mean causation but still it’s worth pondering. Plus my market estimates could be far from reality which since it forms the basis for this analysis this makes it problematic. However, with all the continuing effort and resources being devoted to find the next big thing in permanent magnets it might be worth for the various academic, governmental and commercial researchers to do a back of a chewing gum packet (cigarettes are bad for you) estimate of the production cost and see where your $.MGOe/kg value falls. Is your work likely to produce a niche product (not that there’s anything wrong with that) or does it have the magic to be a mass market product.

Let me finish by saying I am only a mere metallurgist and not an economist so this is a very simplistic analysis (that’s probably an understatement) which I doubt will ever be considered by the HBR! However, I look forward to hearing your thoughts and comments. I can be reached at sales@MagnetUS.com.